WeWork Outlook 2023

December 21, 2023Insight

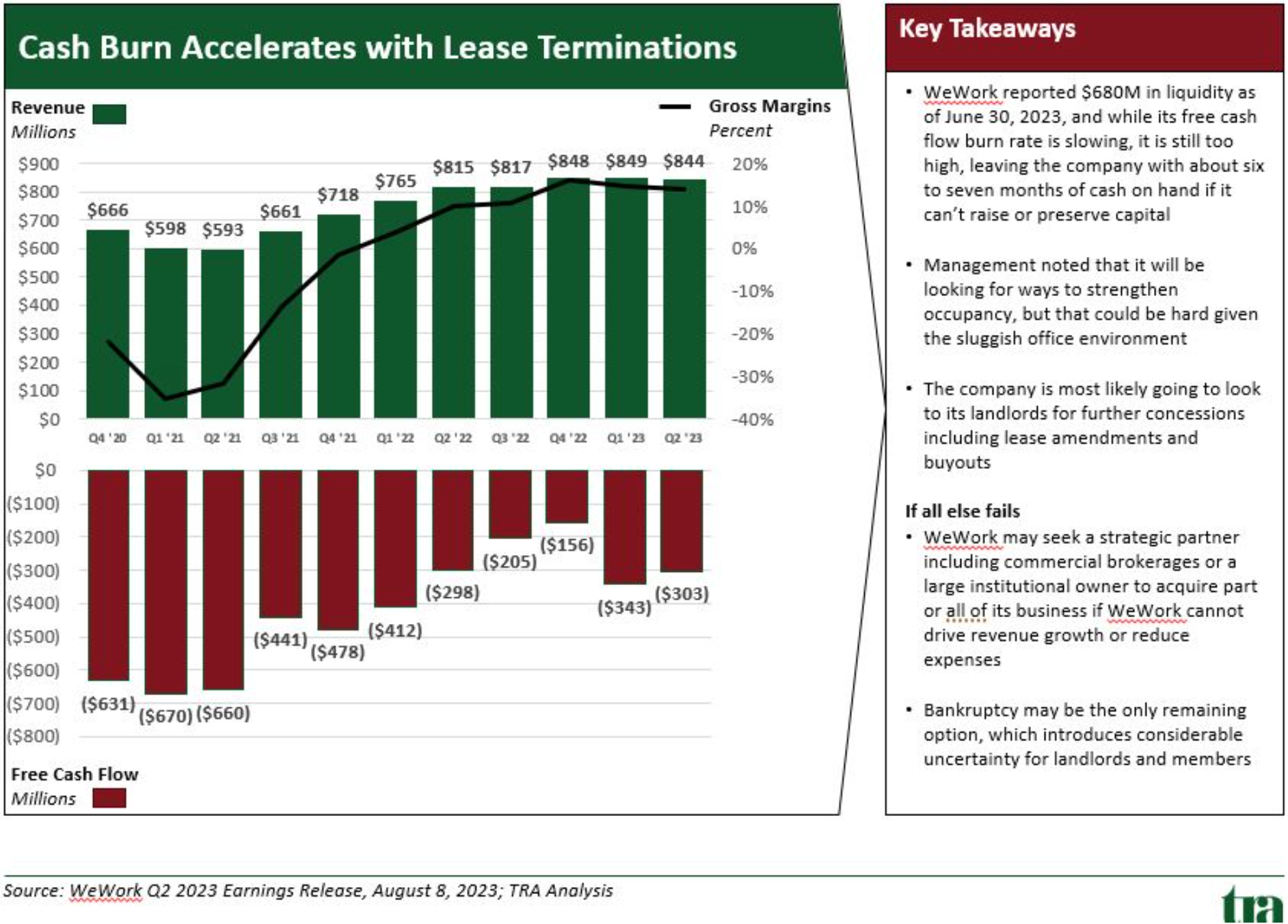

- WeWork reported $680M in liquidity as of June 30, 2023, and while its free cash flow burn rate is slowing, it is still too high, leaving the company with about six to seven months of cash on hand if it can’t raise or preserve capital.

- Management noted that it would be looking for ways to strengthen occupancy, but that could be hard given the sluggish office environment

- The company is most likely going to look to its landlords for further concessions including lease amendments and buyouts

If all else fails

- WeWork may seek a strategic partner including commercial brokerages or a large institutional owner to acquire part or all of its business if WeWork cannot drive revenue growth or reduce expenses

- Bankruptcy may be the only remaining option, which introduces considerable uncertainty for landlords and members